Our Partnerships

Booster Foundation aims to build strong, sustainable partnerships based on a shared vision and underpinned by our values.

Our Values

Our Partners

- Our Partners

- 2025

- 2023 - 2024

MyMahi

MyMahi

MyMahi is an innovative online platform to help young people manage their school life and wellbeing, connect with mentors and plan for ...

MyMahi

MyMahi is an innovative online platform to help young people manage their school life and wellbeing, connect with mentors and plan for their future with further education or employment.

Its resources can grow the financial capability of rangatahi with learning modules that include budgeting, understanding debt and KiwiSaver. MyMahi’s working with the Department of Internal Affairs (DIA) to test how a student’s school ID can also be used by them to verify their identity with DIA to create a verifiable credential which enables students to assert their identity to digitally onboard for services, such as setting up a bank account and/or KiwiSaver and get on their way to financial independence. MyMahi is a commercial enterprise with 120 high schools across Aotearoa signed up so far, and in 2024 over 60,000 young people used its resources. But it’s not only used during school; MyMahi has identified a lot of the use is outside of school hours with young people using it to do everything from looking at their school grades to finding a part-time job.

The Booster Foundation is sponsoring 40x high schools in provincial parts of New Zealand to access MyMahi to benefit students who lack access to facilities like banks and other resources available in cities.

Find out more by visiting MyMahi.

Financial Education and Research Centre

Financial Education and Research Centre

Upskilling financial capability training

Financial capability programmes teach people how to manage their money ...

Financial Education and Research Centre

Upskilling financial capability training

Financial capability programmes teach people how to manage their money and improve their economic wellbeing. But with varying expertise and experience levels, there is demand for more training.

The Booster Foundation is partnering with Te Kunenga ki Pūrehuroa Massey University to support its Financial Education and Research Centre (Fin-Ed Centre) to deliver a workforce training and development programme for all financial capability providers, filling a gap in the sector by growing the skills of the people who help New Zealanders get more financially savvy.

The Fin-Ed Centre is recognised internationally for its work in financial education and research and is New Zealand’s leading research centre on the financial capability and wellbeing. The workforce development competency training will be accredited through Massey University and will include specialised, real-world modules delivered by financial capability providers.

As well as partnering with the Fin-Ed Centre to supporting the workforce development programme, the Booster Foundation will also sponsor the Fin-Ed Centre’s operations to support its mission to provide financial capability research, evaluation and consultancy.

Find out more by visiting Massey.

Te Waha o Rerekohu Area School

Te Waha o Rerekohu Area School

Te Waha o Rerekohu Area School: Shaping financial whizz kids

Nestled beneath Te Maunga o Whetumatarau in ...

Te Waha o Rerekohu Area School

Te Waha o Rerekohu Area School: Shaping financial whizz kids

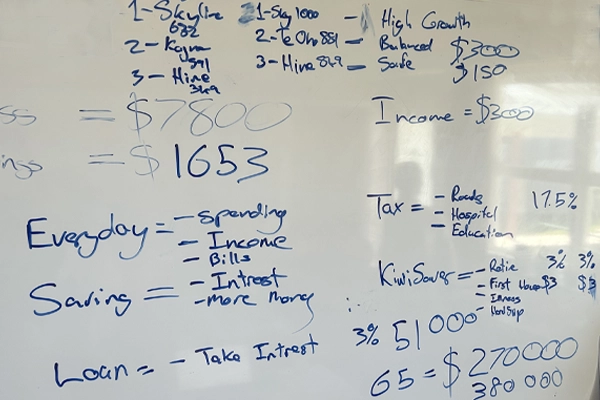

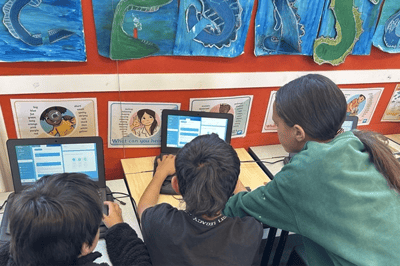

Nestled beneath Te Maunga o Whetumatarau in Tairāwhiti Gisborne, Te Waha o Rerekohu Area School is a hub of financial creativity and learning. Thanks to the partnership led by Cain Kerehoma of Kiko Innovation and supported by the Booster Foundation, the school is on a mission to shape students into money-savvy individuals.

Through the innovative Banqer programme, students not only learn about finances but earn for their KiwiSaver accounts, blending education with real-world experience. This two-year pilot, captured on avideo project, could help spark further expansion through Tairāwhiti and beyond.

The focus is to inspire tamariki to be confident with money. Cain sees this is a long- term strategy to “build our hapu’s wealth over generations and invest in the future of our tamariki, by getting primary aged kids on their long-term savings journey and kick starting their KiwiSaver.”

Students are already reaping the benefits, learning valuable lessons about wise spending, saving, and the power of interest.

The pilot started with 30 primary school students in 2023. Of those, 21 have now enrolled in KiwiSaver, with the majority selecting a high-risk fund, reflecting the long time they have before needing to access it for a first home or their retirement.

‘Matua Ryno is teaching us how to use our money wisely. Koka Lisa has given us jobs in class for us to get paid into our Banqer. We can earn money by our good learning attitude and achievements. I am to listen all the time.’

‘I’ve been learning how to invest and save in Banqer. I love Tuesday because Matua Ryno comes in to talk about how we can get good interest.’

Find out more, read the full Te Waha o Rerekohu Area School case study.

Ngā Tāngata Microfinance – My Money Kete

Ngā Tāngata Microfinance – My Money Kete

My Money Kete: Empowering financial freedom for Kiwis

The Booster Foundation has partenered with Ngā Tāngata ...

Ngā Tāngata Microfinance – My Money Kete

My Money Kete: Empowering financial freedom for Kiwis

The Booster Foundation has partenered with Ngā Tāngata Microfinance since 2022 to back its innovative My Money Kete project. This online platform, bursting with engaging videos, educating Facebook posts and enlightening webinars, is more than just a learning tool — it's fostering financial empowerment.

Designed to equip Kiwis with crucial money management skills and the confidence to stay debt-free, My Money Kete helps people take control of their financial lives. Its dynamic digital format has accelerated its reach, smashing its first-year goal with over 1,200 subscribers in just six months. Three years in, MMK membership is at over 3800 and growing. They have recently launched ‘Friends of My Money Kete’ to reach even more financially vulnerable New Zealanders by partnering with like-minded organisations to share knowledge, collaborate on resources, and explore new ways to help Kiwis get ahead with money—together.

My Money Kete isn't just teaching financial literacy; it's igniting a revolution in money mindfulness.

- A whopping 80% of My Money Kete members have reduced their debt

- 52% have started to make regular contributions to KiwiSaver

- 49% have started to make regular savings.

In recognition of Ngā Tāngata Microfinance’s unwavering commitment to empowering individuals and whānau through safe, fair, and supportive financial solutions they have also been named in the MoneyHub Editors’ Choice Awards 2025 as Favourite Money Management Service. What a fantastic achievement!

Find out more, read the full Ngā Tāngata Microfinance case study.

^November 2024 survey of members.

More than Money

More than Money

More than Money: Inspiring Pasifika youth with life smarts

In 2023 Booster Foundation partnered with Clementine ...

More than Money

More than Money: Inspiring Pasifika youth with life smarts

In 2023 Booster Foundation partnered with Clementine Ludlow-Henare from More Than Money to support the pilot of Life Smarts in South Auckland. A transformative programme working with churches and community groups, it helps young people and their families achieve financial resilience.

Targeted at Pasifika youth, it aims to equip young minds with essential financial resilience skills like mastering budgeting to understanding the importance of goal setting.

It instils a community-first ethos, supporting participants to become financial ambassadors within their families and networks. Nearly 90 young people are already part of this journey, sharing their newfound wisdom and shaping a more financially savvy future.

Targeted at Pasifika youth, it aims to equip young minds with essential financial resilience skills like mastering budgeting to understanding the importance of goal setting.

Testimonies from members like Tupo and Cory highlight the programme's transformative impact, showing how Life Smarts is not just teaching financial skills but helping change lives and build community leaders.

Tupo, a Life Smarts member, says: ‘It is very good teaching everyone about saving and also the differences between wants and needs, also helping everyone out with their own kind of struggle with money.’

Cory adds: ‘This framework has really opened my eyes to the financial side of life as I was not educated about the topics of spending/saving in high school and university. I believe this has had a positive impact on my life as these essentially are life skills that I could further project onto my younger sibling. These skills include spending habits, saving structures, setting goals and calculations.’

Find out more, read the full More than Money case study.

Te Whenua Group

Te Whenua Group

Te Whenua Group: Securing homes and futures

The Booster Foundation partnered with Te Whenua Group in 2024 to ...

Te Whenua Group

Te Whenua Group: Securing homes and futures

The Booster Foundation partnered with Te Whenua Group in 2024 to develop its ‘He Whare Tōnui’ pilot programme that gives whānau the essential education and skills to securely own their homes.

TWG, a kaupapa Māori social enterprise has long partnered with several Iwi, hapū and whānau groups throughout Aotearoa New Zealand.

Based in the Horowhenua district, the pilot brought together whānau from across the rohe to learn more about money, how to secure their own home, retirement and family wealth, as well as how they can support intergenerational change to tackle deep-rooted inequities.

With learning taking place at wananga, iwi rūnanga or marae, the programme was culturally responsive and a safe space to help normalise kōrero around money and give participants the confidence to expand their financial knowledge.

“The ache for home lies in all of us, the safe space where we can go as we are and not be questioned” — Maya Angelou

Find out more, read the full Te Whenua Group case study.

IndigiShare

IndigiShare

IndigiShare: Expanding the power of koha and breaking down financial barriers

IndigiShare* is a charitable trust ...

IndigiShare

IndigiShare: Expanding the power of koha and breaking down financial barriers

IndigiShare* is a charitable trust led by mātauranga Māori that empowers communities through self-determination and economic resilience.

Through its Te Whare Manaaki concept, IndigiShare aims to assist Māori businesses by connecting those starting or growing a business who need capital, with a community of ‘Koha Lenders’. The tikanga-led initiative programme helps equip small and medium-sized enterprises with the tools to get 'loan-ready' so that they can access capital and make their plans a reality.

The Booster Foundation supported IndigiShare to develop their 'Te Aka Matua' pakihi incubator programme, which reframes wealth and impact. The first cohort in late 2024 was made up of 16 SMEs spanning industries from trades and services to health and retail, with each founder bringing a unique perspective and experience to the kaupapa.

The second cohort started in Rotorua in mid-2025 with 15 participants who are diving deep into financial literacy, strategic planning, and crafting their whakapuaki (business pitch) to help their pakihi thrive.

*Established in response to the COVID crisis, IndigiShare strives to create a world for Māori where the power of koha grows and enables positive impact. By drawing on indigenous knowledge, IndigiShare is shifting power into the hands of communities. It is building a circular flow of resources that supports economic resilience and sustained self-reliance for future generations.

[Image] The first recipients of Te Whare Manaaki’s pilot loan are Rotorua-based FE Roofing, a kaupapa Māori construction company providing custom roofing solutions with a tikanga-Māori focus.

Find out more, read the full IndigiShare case study.

O Le Nu’u Trust

O Le Nu’u Trust

O Le Nu’u Trust: Providing a Pasifika approach to financial resilience

O Le Nu’u Trust is a community-led trust ...

O Le Nu’u Trust

O Le Nu’u Trust: Providing a Pasifika approach to financial resilience

O Le Nu’u Trust is a community-led trust founded on Christian values providing wellbeing services to Pasifika people throughout Aotearoa, based in Wellington.

OLNT wants to empower Pasifika wellbeing in New Zealand. OLNT is leading an innovative programme to develop a fully equipped Pasifika financial capability workforce of trainers and facilitators.

The Booster Foundation is providing funding across three years in collaboration with the J R McKenzie Trust.

Using a collective village as a model, O Le Nu’u will draw on existing programmes and support their reach into the Pasifika community with a coordinated, collective approach allowing for a consistent way for people to access various programmes across the country.

OLNT’s approach will provide a Pasifika lens to issues, with mentors well-versed in Pasifika cultures and values, who can provide advice and support that resonates with their community.

Andrew Perez, CEO of OLNT says, “Developing a positive financial mindset entails building awareness, setting achievable goals, embracing healthy financial habits, and nurturing a resilient and optimistic attitude toward wealth and money. This approach not only improves financial health but also enhances overall well-being and life satisfaction… This mindset also empowers individuals to take control of their financial futures and make meaningful contributions to society. Pasifika people are courageous, resilient, and communal. These programmes build on these and look to amplify these in the various contexts of each participant.”

The pilot launched in 2024 will initially work across three regions; Porirua, Palmerston North and Horowhenua with a view to rolling the programme out nationwide once it is complete.

“We like learning about organisations around Aotearoa New Zealand that also aim to address issues of financial resilience and inequality, particularly those deeply rooted in our communities. “

“Feeling in control of your money is lifechanging. ”

“This framework has really opened my eyes to the financial side of life as I was not educated about the topics of spending/saving in High School and University.”

“I used to buy on impulse, so now I go shopping with a list and stick to it, I’ve learnt so much I have set little goals and it feels so good.”