Ngā Tāngata Microfinance

Case Study

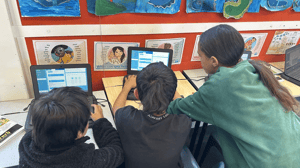

Free online education and support

Since 2009, Ngā Tāngata Microfinance (NTM) has been offering fairer, kinder, interest-free loans to New Zealanders who’ve hit a tough patch and don’t know where to turn.

The Booster Foundation partnered with NTM in 2022, to build a free, online education and support programme My Money Kete that empowers financially vulnerable New Zealanders to learn how to manage their money more effectively.

It’s offered to NTM’s current client base of low-income New Zealanders with active NTM microloans, any new loan applicants and users of their website.

‘Kete’ is a Māori term for a traditional woven basket

and Jade Tapsell, CEO of NTM, says it’s a good metaphor to illustrate all the resources it holds; online workshops, videos, social posts and step-by-step guides, including budgeting tools, savings tips and debt management resources.

“These are all backed by a community of support on Facebook and live chat on the website. And because it’s online, the programme is easily accessible to all Kiwis, including those living in remote locations who wouldn’t otherwise have access to budgeting services”

My Money Kete is going from strength to strength, with over 2,600 members and high levels of engagement amongst members.

As at July 2024, 613 Kiwis have viewed the My Money Workshops, while nearly 900 people have joined My Money Kete’s closed Facebook group.

With plans to expand its reach and add more resources including more involvement of financial mentors, My Money Kete is set to reach even more New Zealanders and grow their financial capability.

My Money Kete had already exceeded their targets six months after launch, a survey to members found:

86% |

say their debt is more manageable |

79% |

reduced their debt |

77% |

understand the difference between good vs bad debt |

66% |

have learnt and improved how to budget |

56% |

of participants have a better undestanding of money |

49% |

have started to make regular contribitions to KiwiSaver |

45% |

reported increased savings |

45% |

have an emergency fund |

New Zealanders like Rona* joined My Money Kete after seeing an ad on Facebook.

Having been in debt throughout her entire adult life, she says the programme was a real turning point.

"Now I have money left at the end of the month and that feels amazing. My Money Kete is there to help you get ahead and you really feel that. And it’s free. I tell people they have to sign up, because taking control of your money is life changing.

“The workbook said, ‘start small’, which I did. But once I got going, I thought ‘I’m going pay $10 off this week rather than $5’. It was such a great feeling and the more I paid off, the more I wanted the bills gone.”

If you'd like to find out more visit Ngā Tāngata Microfinance.

* Name changed to protect identity.

Exploring what a more inclusive, equitable financial system could look like, starting with education and KiwiSaver.

Read More

The Life Smarts programme is lifting the financial capability of Pasifika youth.

Read More

Seeking to address these disparities by providing a stable foundation for home ownership, which is pivotal for financial security and community resilience.

Read More

Strives to create a world for Māori where the power of koha grows and enables positive impact.

Read More