More than Money

Case Study

The Life Smarts programme is lifting the financial capability of Pasifika youth.

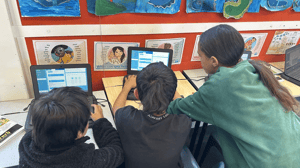

The Life Smarts programme, run in South Auckland by More Than Money (MTM) seven times since the beginning of 2024, is lifting the financial capability of Pasifika youth.

The Booster Foundation partnered with MTM to pilot the programme and provide financial skills like budgeting, saving, KiwiSaver, understanding debt and spending habits, insurance and financial goal setting.

Life Smarts is designed to ensure it has a ‘multiplier effect’ with values-based principles like family, collective thinking and sharing of resources, so youth can share their improved financial knowledge to

positively impact their lives and their aiga in the long term.

A “massive difference”

Melaraena Robertson, an early participant in the course run through the Mascot Bible Chapel – Mangere, says it has made a “massive difference” to how she spends because she has learned the difference between wants and needs and says it’s “helped me save a lot of money”.

Melaraena is also “having a lot of conversations with other people about finance and being smart with money” and is being trained by MTM to facilitate Life Smarts sessions through the Martin Hautus Foundation Trust.

““I am so grateful to be able to help educate our

younger people on the importance of being smart with money especially when it is definitely something I wished I had learnt earlier on in life,”

- Melaraena

After completing Life Smarts, 90% of participants felt either very confident or confident managing their money compared to 27% at the start of the programme.

The Director of MTM, Clementine Ludlow-Henare, says most New Zealand youth have little to no understanding of simple money concepts.

“We cover topics with lots of activities and discussion, so we facilitate rather than teach, to help build mutual trust and respect by hearing our youth and acknowledging their experiences and wisdom. In return, we find they are engaged and take in the information well.”

"Really eye opening. Seeing how much

unnecessary things I spend money on.

Implement structure into my saving and

money system. Loving every second of this

programme.”-Student

“The best impact we see is the conversations these awesome youth then have with others. They’re our ambassadors, paving the way for their communities to get ahead financially.”

85% |

have a better understanding of insurance |

82% |

are more aware of needs vs wants and 48% have cut back on their 'wants' spend |

61% |

have started saving for a specific goal |

61% |

are now following a personalised budget |

58% |

are continuing to use a spending diary |

42% |

have looked into or started a KiwiSaver account and 36% have increased their KiwiSaver contributions |

If you'd like to find out more visit More than Money.

* The survey was of 33 students with a 63% response rate. The average age of participants is 20 years.

Exploring what a more inclusive, equitable financial system could look like, starting with education and KiwiSaver.

Read More

Offering fairer, kinder, interest-free loans to New Zealanders who’ve hit a tough patch and don’t know where to turn.

Read More

Seeking to address these disparities by providing a stable foundation for home ownership, which is pivotal for financial security and community resilience.

Read More

Strives to create a world for Māori where the power of koha grows and enables positive impact.

Read More